Let’s take a look at Rapid Formations Business Registration in the UK. For every business that wishes to operate in the UK, this is an opportunity to make use of.

Starting a business in the UK is an exciting yet intricate process, and selecting the right business registration service can make all the difference.

Rapid Formations, a leading company formation agent, offers tailored solutions to simplify this process for entrepreneurs and small business owners.

This article will guide you through the essentials of Rapid Formations business registration in the UK, providing actionable tips, industry-specific examples, and expert insights to set you on the path to success.

READ ALSO: Best UK Business Registration Companies

Why Choose Rapid Formations?

Rapid Formations has established itself as a trusted partner for UK business registration. With over 100,000 companies formed annually, their expertise spans multiple industries and business types.

Here are some reasons why entrepreneurs prefer Rapid Formations:

- Speed: Register your business in as little as 3 hours.

- Affordability: Packages start from £12.99, catering to various budgets.

- Comprehensive Services: From registered office addresses to VAT registration, they provide end-to-end solutions.

- Customer Support: Expert support available via phone, email, and live chat.

Types of Entities That Can Be Formed in the UK

Choosing the right type of business entity is a crucial step in the registration process. Here are the primary types of entities that can be formed in the UK:

1. Private Limited Company (Ltd)

A private limited company is the most common business structure in the UK. It provides limited liability protection, meaning the personal assets of shareholders are protected in case of business debts.

Key features include:

- Separate Legal Entity: The company is distinct from its owners, allowing it to own assets, enter contracts, and sue or be sued.

- Limited Liability: Shareholders’ liabilities are limited to their share capital investment.

- Tax Efficiency: Potential tax benefits compared to sole proprietorships.

- Professional Image: Often perceived as more credible by customers and investors.

This type of business structure is ideal for small businesses, startups, and those seeking external investment.

2. Sole Trader

A sole trader business is the simplest and most flexible structure, often chosen by freelancers and self-employed individuals.

Key characteristics include:

- Full Control: The owner has complete authority over business decisions.

- Unlimited Liability: The owner is personally responsible for all business debts.

- Simple Setup: Minimal paperwork and no need to register with Companies House, though HMRC registration is required.

- Taxation: Business profits are taxed as personal income.

This type of business structure suits individuals starting small-scale operations with low financial risk.

3. Limited Liability Partnership (LLP)

An LLP is a hybrid structure that combines the flexibility of a partnership with the limited liability protection of a company.

Key features include:

- Limited Liability: Partners’ personal assets are protected.

- Flexible Profit Sharing: Profits can be distributed among partners as agreed in the LLP agreement.

- Separate Legal Entity: The LLP can own assets and enter contracts independently.

LLPs are particularly popular among professional services firms, such as accountants, architects, and law practices.

4. Public Limited Company (PLC)

A PLC is a company whose shares can be publicly traded on the stock exchange.

Key features include:

- Minimum Capital Requirement: Must have at least £50,000 in share capital, with at least 25% paid up.

- Strict Regulations: Subject to more stringent compliance and reporting requirements.

- Public Investment: Can raise capital from the public by issuing shares.

This type of business structure is typically chosen by larger businesses planning to scale and attract significant investment.

5. Community Interest Company (CIC)

A CIC is a type of limited company designed for social enterprises that aim to benefit the community.

Key features include:

- Asset Lock: Ensures that assets and profits are used for community purposes.

- Limited Liability: Protects owners’ personal assets.

- Regulatory Oversight: Must submit an annual community interest report to the CIC regulator.

This structure is suitable for businesses with social or environmental goals.

6. Unlimited Company

An unlimited company has no limit on the liability of its members.

Key characteristics include:

- Personal Responsibility: Members are jointly and severally liable for the company’s debts.

- Privacy: Financial accounts do not need to be filed with Companies House, ensuring confidentiality.

- Flexibility: Often used for niche or specific business purposes where liability is less of a concern.

READ ALSO: Best LLC Formation Services and Agencies in the USA

Who Should Use Rapid Formations Service?

- Technology Startups: For tech entrepreneurs, registering as a private limited company can attract investors by showcasing a professional structure. Rapid Formations’ virtual office services can help create a prestigious business presence.

- Freelancers and Creatives: Freelancers may prefer to start as sole traders for simplicity. However, upgrading to an Ltd structure can provide tax benefits and enhance credibility.

- E-Commerce Businesses: Online retailers benefit from the limited liability of an Ltd company. Rapid Formations’ business bank account integration can streamline financial management.

Benefits of Registering Your Business in the UK

- Access to a Thriving Economy: The UK ranks among the top global destinations for startups.

- Legal Protection: Operating as a registered company limits personal liability.

- Tax Advantages: Leverage corporate tax benefits, such as the Research and Development (R&D) Tax Credit.

You can consult with a tax advisor post-registration to optimize your tax strategy.

READ ALSO: 1st Formations Business Registration in the UK

How to Register a Business in the UK w/ Rapid Formations

Whether you are a UK resident or non-UK resident, you can easily register your business in the UK by using the Rapid Formations service.

All you need to do is follow these step-by-step guide below.

Step 1. Visit: www.rapidformations.co.uk and enter the name you wish to register in the search box. Search it and see if it’s available.

If your business name is available, you will see a congratulations message like this, if not, you will be asked to try another name.

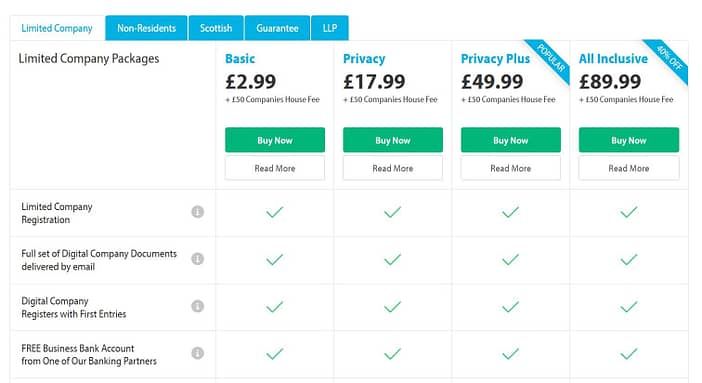

Step 2. Choose a Business Registration Package.

After your name is available for registration, go ahead and click on ‘Choose a Package’ to see all the available packages.

NOTE: If you are applying as a non-UK resident, select the ‘Non-Residents’ option.

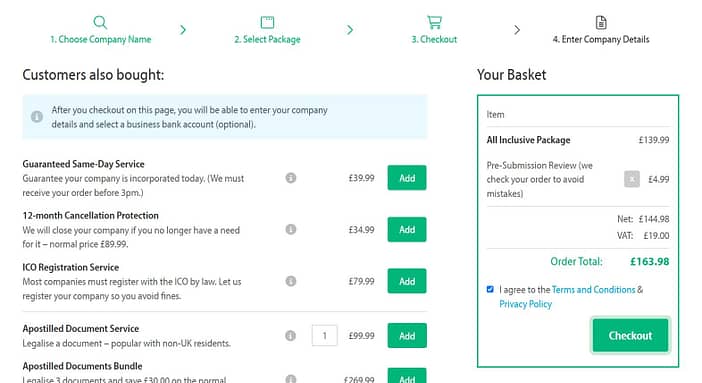

Step 3. Review order and make Payment.

Review your order and add any extra service you want.

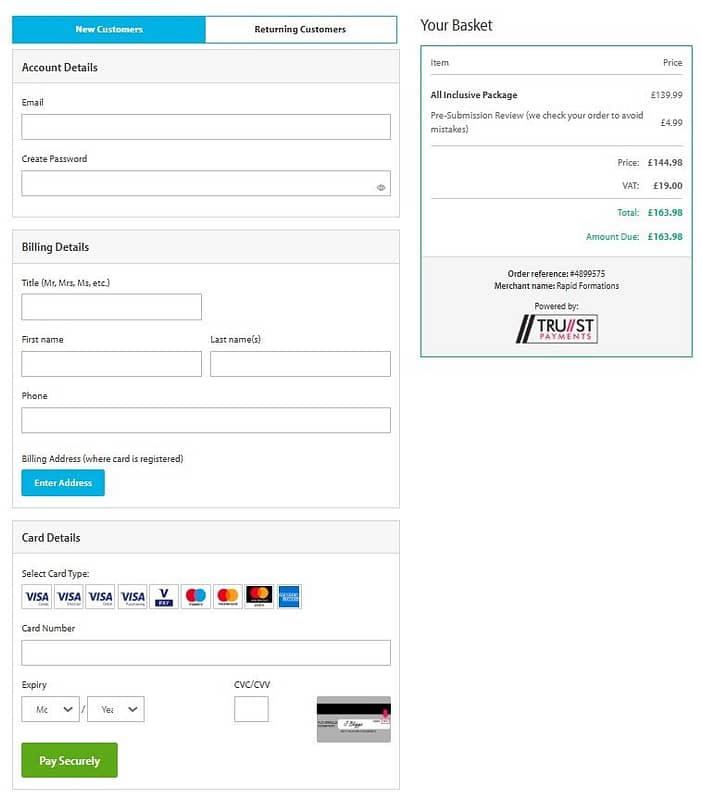

Enter your name, email address, phone number, billing address, and create a password for your account.

After making payments, you will be able to login to your dashboard and update your company details and also monitor the progress of your business registration.

Congratulations! You have successfully registered your business in the UK.

READ ALSO: BetterLegal Business Registration in the USA | How it Works

READ ALSO: Ownr Business Registration in Canada | How it Works Today

FAQs about Rapid Formations Business Registration

With Rapid Formations, your company can be registered within 3-6 hours, depending on the package selected.

Yes, a UK registered office address is mandatory. Rapid Formations offers virtual address services to international entrepreneurs.

All costs are transparent, with optional add-ons clearly detailed during the selection process.

Yes, Rapid Formations supports the registration of charitable companies and other non-profit entities.

Rapid Formations Alternatives

Quality Company Formations

Quality Company Formations, a leading business registration platform, helps businesses worldwide register in the UK with ease and professionalism.

Founded in 2014 and have helped over 350,000+ businesses become fully registered in the UK.

Founded in 2014, 1st Formations have Registered over 1,000,000 Businesses in the UK.

They also offer competitive price and services which makes them one of the leaders in the industry.

Founded in 2020, IncorpUK is fast growing with over 10,000+ Registered Businesses in the UK.

IncorpUK is a worthy alternative and it’s available for both residents and non-UK residents.

In Summary

Registering your business with Rapid Formations ensures a streamlined, efficient, and reliable process, allowing you to focus on growing your enterprise.

By leveraging their expertise and comprehensive services, small business owners and entrepreneurs can confidently navigate the complexities of UK company registration.

Start your business registration today and turn your vision into reality.

Ready to Level Up Your Business Skills?

Join my online school, Online Income Academy, for more expert guides, tutorials, and strategies to help you build a successful business. Sign up today!